Everybody loves passive income and with interest rates as high as they are we’re living in an interesting environment for generating income from your portfolio.

Everybody loves passive income and with interest rates as high as they are we’re living in an interesting environment for generating income from your portfolio.

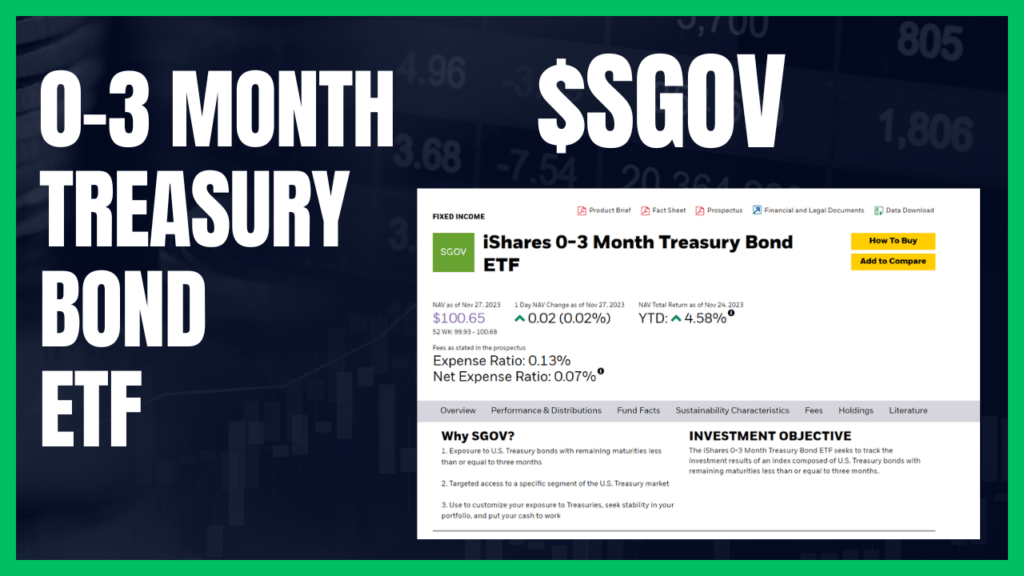

I’ve made several videos on Treasury Bill ETF’s before but today we’re gonna be talking about specifically $SGOV.

What is the objective of the $SGOV ETF?

According to their website, They are seeking to provide a similar investment to the index that tracks a composition of US Treasury bonds That has short term durations including one to three months. Pretty much they are going out and buying short term treasuries on your behalf.

Who manages the $SGOV ETF?

iShares is the collection $SGOV is a part of, but the investment is ultimately managed by Black Rock.

What happens to $SGOV when interest rates come back down?

This fund should be directly correlated with interest rates coming back down, ultimately the dividend yield would be a smaller amount As the ETF is directly correlated with purchasing short term; one to three month Treasury bonds.

Let’s look at the income projections:

$SGOV Monthly Dividend Income Projections:

Below we will illustrate how many shares and how much roughly of an investment it will take to achieve certain monthly income goals:

- $100 / Month

- $250 / Month

- $1,000 / Month

- $5,000 / Month

| Ticker | Current Price | Annual Dividend | Annual Yield |

| $SGOV | $100.75 | $5.39 | 5.37% |

| $100 Month? | Shares | Total Investment |

| 222.63 | $22,430.43 | |

| Shares | Total Investment | |

| $250 Month? | 556.59 | $56,076.07 |

| Shares | Total Investment | |

| $1,000 Month? | 2,226.35 | $224,304.27 |

| Shares | Total Investment | |

| $5,000 Month? | 11,131.73 | $1,121,521.34 |

*Numbers may change based upon when you’re reading this article*