YieldMax is a new fund manager getting a lot of attention these past few months with the release of their new ETFs using a unique options strategy focusing on portfolio income.

Currently, they have 7 US. Listed ETFs, and I imagine if things go well, they will be rolling out more.

| ETF Symbol | ETF Name | ETF Symbol Focus | ETF Inception |

| TSLY | YieldMax TSLA Option Income Strategy ETF | Tesla | 11/22/22 |

| OARK | YieldMax Innovation Option Income Strategy ETF | ARKK’s Innovation Fund $ARKK | 11/22/22 |

| APLY | YieldMax AAPL Option Income Strategy ETF | Apple | 04/17/23 |

| NVDY | YieldMax NVDA Option Income Strategy ETF | Nvdia | 05/10/23 |

| AMZY | YieldMax AMZN Option Income Strategy ETF | Amazon | 07/24/23 |

| GOOY | YieldMax GOOGL Option Income Strategy ETF | 07/24/23 | |

| FBY | YieldMax META Option Income Strategy ETF | Meta | 07/24/23 |

As, these funds grow in popularity their AUM will grow. Currently, the most popular is the Tesla based Option Income based ETF ($TSLY) – at $433.71M AUM, followed by NVDY at $62.59M AUM and OARK at $59.46 AUM.

Annual Dividend Yield

The yields for all of these funds vary – but they are all much higher than the average for these type of funds.

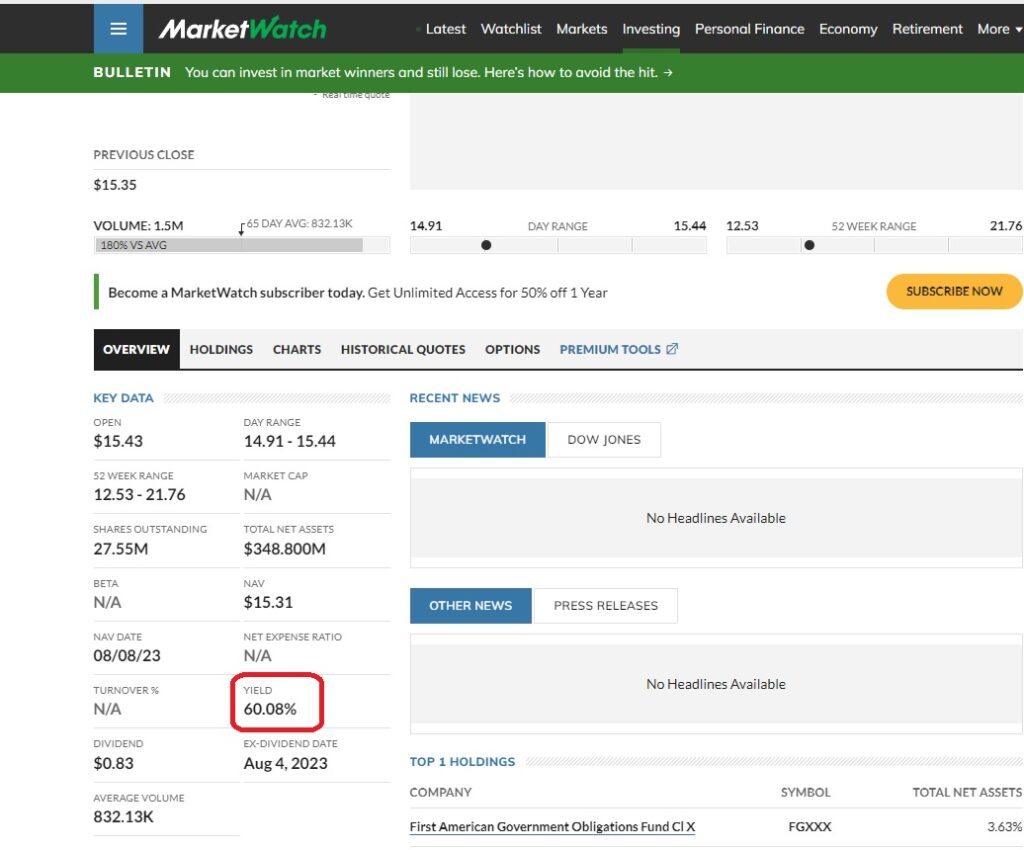

According to Market Watch – $TSLY annual yield is currently at a staggering 60.08% yield.

Now, I’m sure as things go along this number will change and update drastically – so be sure to check back in regularly to see how this yield % will fluctuate.

Expense Ratio

Lastly, as of now let’s talk about the fees YieldMax will be charging for these investment ETFs. To my knowledge, it appears that all 7 of their active ETFs will be charging an expense ratio of 0.99%.

With the amount of work that is required with these type of funds, I think that is a reasonable expense that investors will incur.

Dividend History YTD

TSLY Dividend History – 2023

| Payment Month | Payment Date | Distribution Amount |

| December | ||

| November | ||

| October | ||

| September | ||

| August | 8/14/2023 | $0.8303 |

| July | 7/17/2023 | $1.0661 |

| June | 6/15/2023 | $0.8033 |

| May | 5/15/2023 | $0.4402 |

| April | 4/17/2023 | $0.8286 |

| March | 3/16/2023 | $0.9023 |

| February | 2/16/2023 | $0.9029 |

| January | 1/12/2023 | $0.9986 |

Frequently Asked Questions:

How often are YieldMax’s distributions?

- All 7 of their active Income based ETFs distribute to their investors on a monthly basis. This could change in the future, but this is their current payment / distribution schedule.

Where can I find more information about the fund manager, YieldMax?

- Here is a link to their website – https://www.yieldmaxetfs.com/

What other tickers are YieldMax considering starting funds for?

- According to a recent publication from the SEC – this is what I found as possible future ETF offerings:

- $MSTR – YieldMax MSTR Option Income Strategy ETF

- $BABO – YieldMax BABA Option Income Strategy ETF

- $ABNY- YieldMax ABNB Option Income Strategy ETF

- $MRNY- YieldMax MRNA Option Income Strategy ETF

- $CONY – YieldMax COIN Option Income Strategy ETF

- $NFLY – YieldMax NTFLX Option Income Strategy ETF

How are these (TSLY, OARKK, NVDY, APLY) Dividends taxed?

- First of all, disclaimer we are not tax advisors so please use this response for research / educational purposes only, consult your tax advisor for more concise details. But to our understanding, these distributions will be the mixture of ordinary dividends from the underlying and options premium – which will be taxed at ordinary income tax rates. Similar to how you’d be taxed if you sold a covered call yourself.