Today, I’d like to discuss a new strategy I’m in the works of implementing for my personal banking situation, that I plan to use on a monthly basis.

With current Money Market rates being 4% or more in many cases, it makes me want to get more & more of my money into these accounts instead of my typical bank accounts. Money Markets are historically not this high, so this may be only temporary but I think it could still be a great place to store your cash. Do your own research, it does work a little differently than FDIC insurance that we have with typical bank accounts, the coverage for money markets is SPIC specific.

But with all that being said, let’s jump into the new idea/mindset that I am planning on implementing.

This appears to be the most common flow of people’s money that have a typical 9-5 W2 or 1099 job.

The new strategy “Taxable Brokerage Banking” is structured a little bit differently.

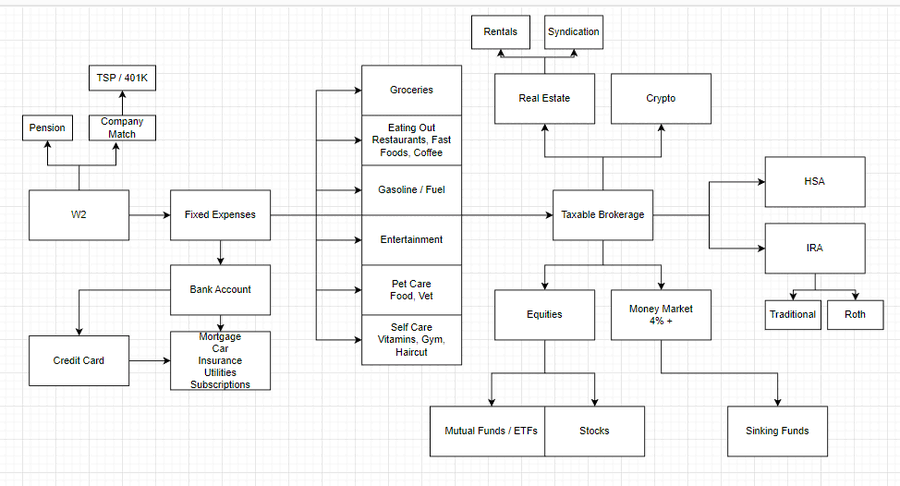

So, I will still plan to use Traditional Banks – but they will not be where most of my money sits. They will be allocated accordingly with a specific amount and purpose. For example – in my budget, I have items that are Fixed Expenses that recur each and every month. Some examples of these are my Mortgage, Insurance, Utilities, Subscriptions & Debt Payments to name a few of the most common. The idea with the “Fixed Expenses” account is that I will allocate only the specific amount needed to cover those expenses. Plus a little buffer, to cover some of the utility payment fluctuations. For example, if my monthly Fixed Expenses total is $1,500 per month, I would divvy up my paycheck to allocate $750 + buffer – per paycheck, biweekly.

Next, the allocations for each of my Budget / Spending Categories. Those categories currently are:

- Groceries, Eating Out (Restaurants, Fast Foods, Coffee)

- Transportation (Gasoline/Fuel)

- Entertainment / Shopping / Gifts

- Self/Family Care – Haircuts, Gym Memberships, Health Supplements, House Cleaning Supplies, House Laundry, Kitchen Supplies

- Pet Care – Food, Medicine, Vet Visits

These are the categories for now but who knows, these could potentially change as we go along & things change.

Each of these will be a separate Bank Account. I know this may be overkill, but I think this will help me keep track of each category and all of their specific transactions better. My employer allows me to allocate my paycheck to many different banks if I choose to, so this will be a good use case that I can implement. Each account will have a certain dollar amount allocated to it each paycheck that I will pre-determine. This way as the month goes along, it will be easy to quickly check the balance to see how much we have left of the original allocated amount. We can always add more if the funds get low & we think we may go over the original decided allocated amount.

After that, the remainder of our paycheck will be dumped into our Taxable Brokerage account.

Video Walkthrough from YouTube:

<

Part of it will be invested into Equities (Mutual Funds / ETFs, Stocks) and the other part will stay in the Money Market earning 4%+. We then also have the option if we’d like to move funds to other Tax Advantaged accounts such as HSAs or IRAs.

Our Sinking Funds could also be a part of the Money Market funds that we’ve allocated.

Lastly, we could then also transfer out to other investments such as Real Estate (Rentals, Syndication Deals, etc) or Crypto if we’d like, straight from our Brokerage Account.

You should be able to order a Debit Card and Checks that can be used to draft money from your account. Check with your specific Brokerage firm for more details as far as that goes.

And that pretty much sums it up. We hope this makes sense and was easy to follow. We made a diagram that can be easier to illustrate, check it out below.

Let us know what you guys think in the comments below!